Although most of the news focuses on the meteoric price rise of Bitcoin, there’s a phenomenon brewing underground. It is referred to as decentralized finance, or Defi, as it’s popularly known.

When you take a quick look at the state of commercial banking, you realize that there’s still a big market out there. At least 1.7 billion people don’t use banks. Small enterprises depend on high-cost financing because banks hardly ever attend to their financial needs. Retailers also lose as high as 3% on each transaction made with credit cards.

When you collate these statistics, they represent a significantly big part of the economy. The attitude of banks toward small-sized firms discourages investments, which affects national income growth. Some of these unbanked customers buy bitcoin to bridge the technology gap.

The Solution Decentralized Finance Offers

Decentralized finance solves most of the prevalent issues in today’s financial system. While it could be opined that several fintech alternatives counter these issues, most of them follow the traditional financial system. They’re more or less like repackaged versions of the current banking system.

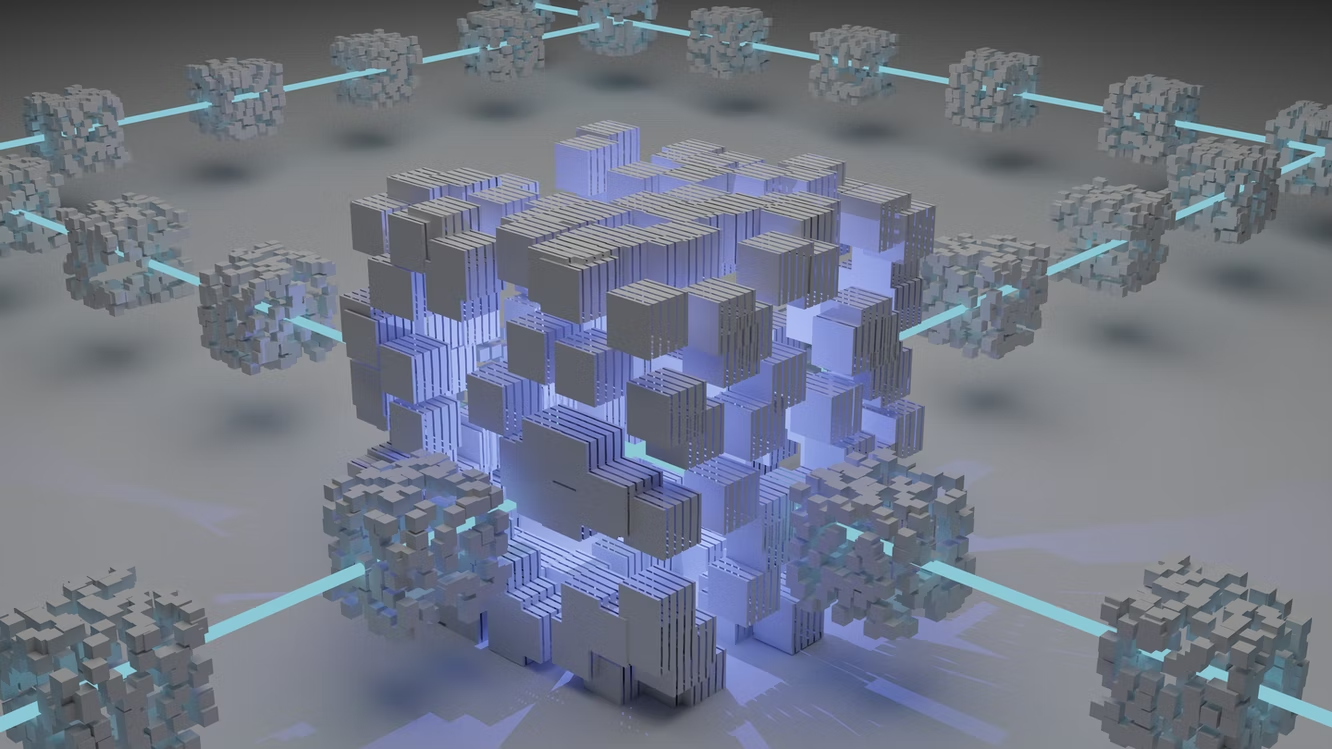

Any solution utilizing blockchain technology will stand out and become a better and longer-lasting answer.

Decentralized finance implements a democratic system that isn’t controlled by any entity. The system is peer-to-peer, allowing direct interaction between businesses and lenders. Taking off the intermediaries such as banks also will enable businesses to enjoy a greater percentage of their profits. Transactions are also quicker, and there’s no form of discrimination.

Defi has strikingly similar features to the barter system. Two parties facilitated Barter, each wanting goods in return for another. This system was not workable because of its need to match precisely two commodities.

Money was presented as the solution to the vital barter system problem of matching commodities. Fiat money changed from shells to paper money, and now credit cards. Nevertheless, the financial system has remained the same.

The interest rates on loans are neck-breaking. Imagine a situation where an entrepreneur has an idea that’ll bring 15% returns on investment per annum. Then the bank slams the potential startup with a 20% per annum interest rate. That would effectively discourage its creation.

Defi solves five key problems in the financial system. Firstly, it breaks down centralized control. Secondly, it shuts out limited access to loans and incompetence. Thirdly, it introduces transparency and prevents a lack of interconnected operations.

Conclusion

The conventional financial system poses several issues like restrictions on funds for small enterprises and high credit card fees. Banks are unneeded intermediaries that can be displaced with Defi’s peer-to-peer system.

Decentralized finance presents the financial space with several solutions like democratic processes, access to loans, and the displacement of centralized control.