The idea of cryptocurrency trading platforms has been around for a few years now, but rarely do they offer much flexibility for their users. Recently unveiling a redesigned, next generation platform that lets users connect their account with 30+ top crypto exchanges, Bitsgap offers an alternative crypto trading system that is set to blow the competition out of the water.

With three years in business already under their belt, Bitsgap has a leg up on other automated cryptocurrency trading platforms in terms of experience and know-how. They plan on using this advantage to help take them to the top of the industry, bringing their customers along with them.

What is Bitsgap?

At its core, Bitsgap is an advanced solution for crypto trading and arbitrage that provides its users with a flexible array of options. Bitsgap offers all the functionality of a regular automated crypto trading platform along with special features not shared with others, including access to backtesting data, smart orders, and the use of up to 15 different trading bots simultaneously. It is accessible by all types of devices, has a user-friendly interface and supports connections with most of the industry’s top exchanges.

In addition to conducting arbitrage trades among hundreds of different cryptocurrencies on over 30 different exchanges, Bitsgap allows for several different types of trades to be made, including market orders, limit orders, stop limit orders, and even shadow orders (hidden from the orderbook). Included is a number of support tools, such as portfolio tracking, signals, and bot management, all managed from one dashboard.

Bitsgap also features a demo version of their platform so users can first practice their trading. This is a great way to learn all the ins-and-outs of how the platform operates without having to risk real funds, giving users a chance to develop a sense of familiarity with it.

Bitsgap Security

While the Bitsgap platform itself is professionally designed and built for maximum stability, no deposits of customer trading funds are ever made on to the platform itself, which means it is risk-free as far as funds security is concerned. Instead, customers connect their exchange accounts to Bitsgap using the API keys of the exchanges.

Using an API connection that does not include withdrawal privileges means that Bitsgap will never have access to customer funds held on exchanges, where they remain safely stored. It only allows them to conduct trades on behalf of the user. Additionally, all orders through API are secured by Bitsgap using high-end 2048-bit encryption.

Features of Bitsgap

Below we discuss the main components of Bitsgap which are represented as a series of tabs at the top of the home screen after logging in.

Trading

This is the main trading screen for exchanges connected to Bitsgap by the user via exchange API. It basically allows users to conduct trades on all their exchanges at once instead of having to manually log in to all of them. It features an orderbook, interactive chart screen, list of coin pairings, recent trades, order screen, and open orders, along with the user’s balance on the exchange, open positions, and trade history. The current exchange can be changed by clicking on the name of the exchange found above the chart screen. This will bring up a list of the 30+ exchanges that can currently be connected to Bitsgap.

In addition to the basic market and limit order types, some of the more advanced orders that can be placed through Bitsgap include:

- Stop-loss/take profit orders. Using this type of order will make sure that orders are executed upon reaching a certain price limit. These orders are used to minimize losses or maximize gains.

- Shadow orders. This allows users to place orders that are not reflected in the exchange order book. The order still exists per instructions sent via API connection but cannot be seen by other traders.

- Smart orders. This is an advanced order which sets a simultaneous combination of stop-loss and take profit orders, available to those with upgraded plans only.

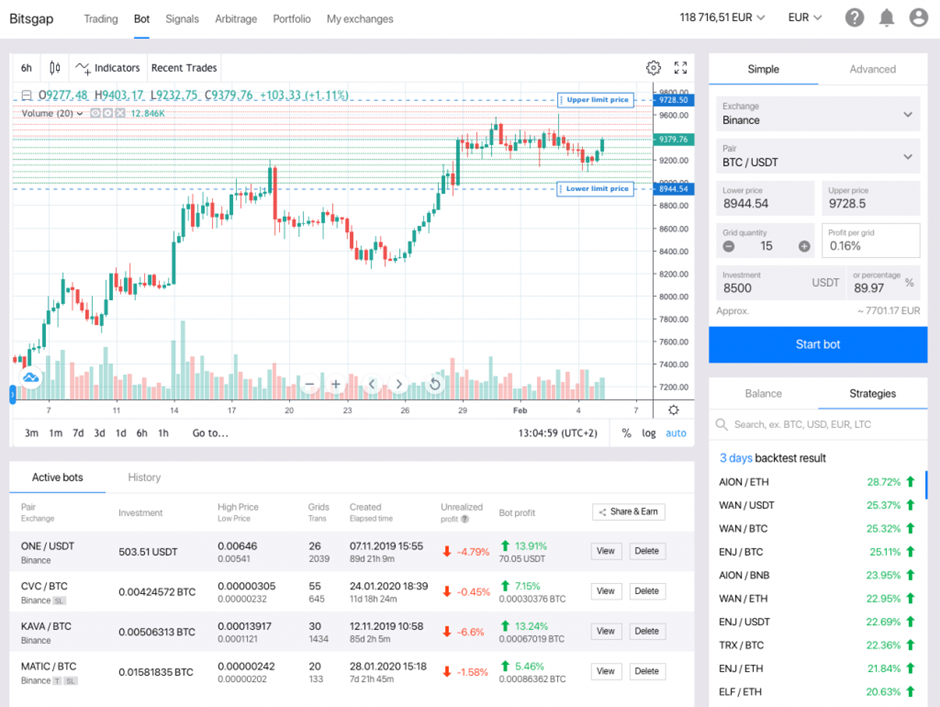

Bots

This is where Bitsgap’s selection of trading bots can be found. Once a platform user has a coin balance on an exchange and has successfully connected that exchange’s API to their Bitsgap account, they can activate the bot of their choice to start making automated trades for them. To the right of the coin pairing chart are different options for selecting the bot, exchange, coin pair, configuration options, and maximum amount to be traded by that bot.

Below that is a list of the most successful trading strategies for the particular bot selected based on backtest data, which is a simulation of how the bot would have performed when trading different coin pairings offered by the selected exchange. The backtest result can be displayed according to returns delivered in the last month, week, or 3 days. Bots can be started with just a few clicks and profits tracked in the History tab of the screen (to the left of the backtest performance results).

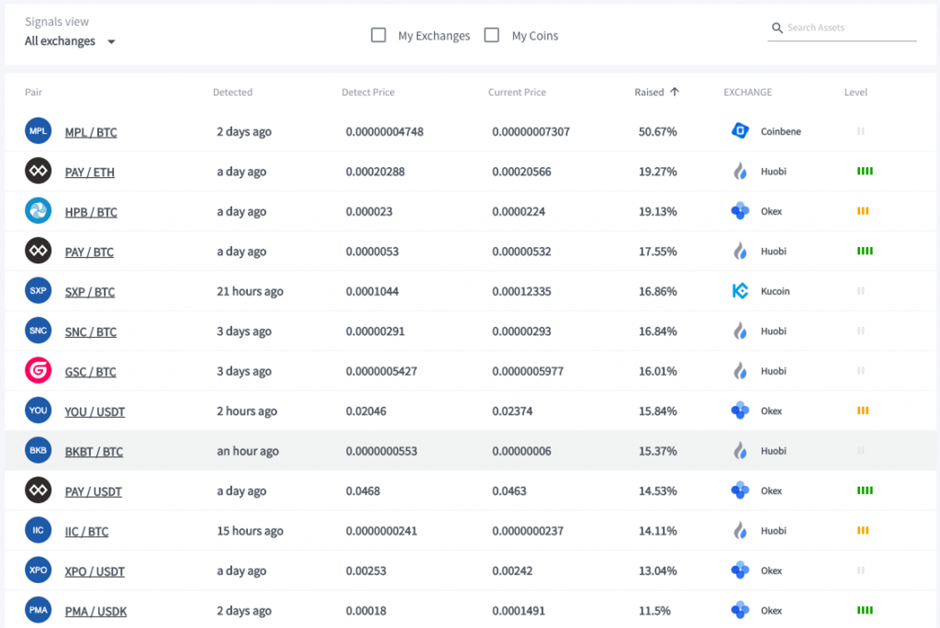

Signals

This tab displays potential buy opportunities as detected by Bitsgap’s special crypto monitoring algorithms. They run across all supported exchanges 24/7, scouring thousands of trading pairs for price movement anomalies. Displayed for each entry is the exchange the signal was detected on, the “level” of the signal (higher level = stronger signal), the detected price vs. current price, and how long ago the signal was detected. Click on a signal to be transported to the Trading tab screen for that particular exchange and coin pair.

According to language on their website, Bitsgap defines a price event as being worthy of “signal” classification as such:

“When the price of a coin is starting to show an anomaly out of pattern which forms an upward trend, we add this entry into our signal list. To verify the trend we are using numerous indicators and models before considering any rapid move as a trading signal.”

Arbitrage

Arbitrage trading is the strategy of buying a coin for a lower price on one exchange and selling it for a higher price on another. It has long since been the “bread and butter” of Bitsgap, and while it may seem like easy money, it is a lot trickier than it sounds. Because it is difficult and requires some degree of experience, the Arbitrage option is only available to those with the Advanced or Pro upgrades.

Bitsgap Arbitrage feature generates a list of potential arbitrage opportunities calculated across the 30+ exchanges supported by the platform, arranged by order of potential profitability. It requires that users have decent-sized balances of coins across multiple exchanges all linked to Bitsgap via API. Potential arbitrage opportunities are calculated according to the account balances on the involved exchanges, allowing users to select crypto or fiat opportunities.

Conducting automated arbitrage through the Bitsgap platform is a far superior method to attempting to do it manually. This is because arbitrage opportunities are spotted quickly and trades on both exchanges conducted with just a single click.

Portfolio

This tab allows users to view the entirety of the crypto and fiat holdings across the breadth of exchanges linked to Bitsgap via API. Holdings can be shown either by coin or exchange. Open orders and order histories can also be viewed across multiple exchanges.

My exchanges and Demo feature

This is where a list of user exchange accounts connected through API are shown. In the upper-right corner is a button that says “Switch to demo”. By clicking this, users can activate the Demo feature which will allow them to practice using all of the previously mentioned components of the Bitsgap platform, for free. Demo accounts start with 1 BTC on 11 different exchanges which can be used to make trades, activate bots, capitalize on signals, or even conduct arbitrage.

There’s probably no better way to understand and familiarize oneself with all that Bitsgap has to offer than by practicing with the Demo feature.

Registering on Bitsgap

The registration process for Bitsgap is quite simple and only requires the verification of an email account. Alternatively, users can connect via their Google or Facebook accounts. New accounts come with a 14 day free trial in which several features can be used free of charge. The next step to take will be linking accounts on exchanges to Bitsgap through entering in the API Key and Secret Key provided by each exchange. Remember: so long as API settings do not include “enable withdrawals”, it is impossible for Bitsgap to withdraw your funds (exchanges do not include this by default).

Exchanges used by Bitsgap

Bitsgap currently supports API connections with over 30 exchanges, and they are steadily adding to this list. Below is a list of a few of the major exchanges used by Bitsgap.

Bitsgap subscription pricing

After the user’s 14 day free trial has expired, there are several options available to continue using the platform, including a free account with limited trading options. Subscription models include:

- Basic ($19/month). Access to standard features with a $25,000 monthly trading limit.

- Advanced ($44/month). Access to extended features including automation and arbitrage with a $100,000 monthly trading limit.

- Pro ($110/month). Unlimited access to all Bitsgap features and an unlimited trading limit.

Summary Bitsgap is a revolutionary cryptocurrency trading platform that offers its users a wealth of options that simply aren’t available through similar operations. Highly intuitive and sleek in design, Bitsgap allows for a near infinite amount of trading possibilities thanks to its ability to unite an unprecedented number of top cryptocurrency exchanges all under one roof. Advanced trades can be made safely, securely and instantly, removing the hassle of having to log in and out of multiple exchanges, saving time and maximizing profits in the process.