Key takeaways:

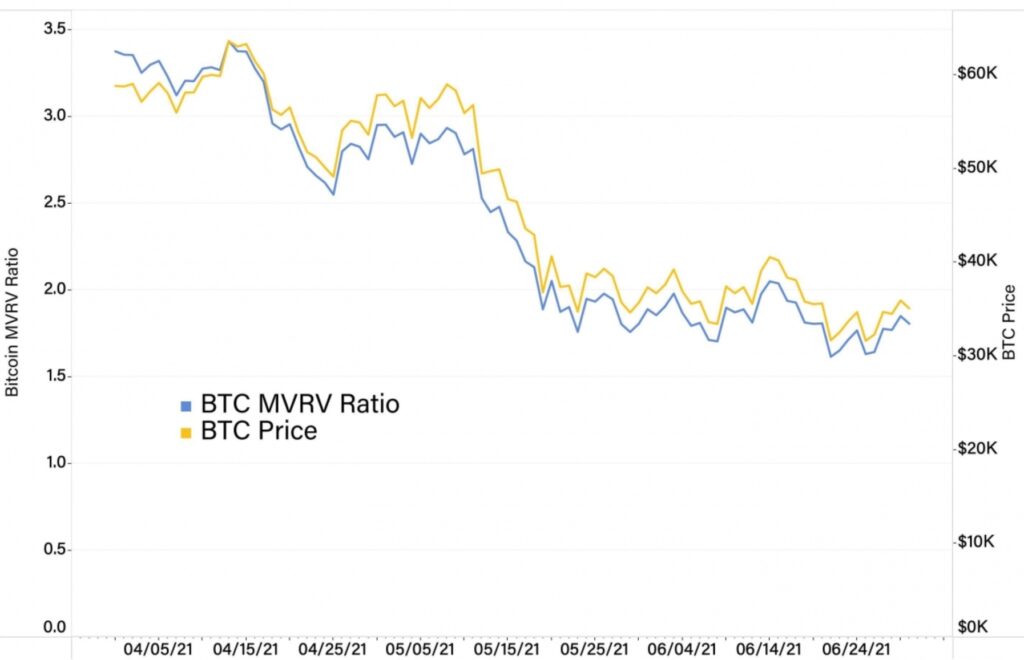

- Market metrics, MRVR and Puel Multiple, point to the current market undervaluation of Bitcoin

- Chinese crackdowns on Bitcoin mining has been largely responsible for the negative market trend during the last three months

- Upcoming Taproot Bitcoin upgrade shows the coin’s ability to adapt to new changes and reminds critics that Bitcoin is still developing and exciting technology

As always, when the market decline happens, Bitcoin critics are quick to come out of the woods and point out why, in their opinion, the digital currency is doomed in the long run. However, those who truly appreciate everything Bitcoin has to offer, use the opportunity of the market downward trend to examine the underlying market metrics and try to better understand market behavior, unaffected by bullish trading actions.

It might seem like years have gone by, but only three short months ago on this day, Bitcoin reached its all-time high price of $64,816. Since then, the world’s largest digital currency has lost almost exactly 50% of its value and is trading at $32,490, at the time of this writing.

What are some encouraging Bitcoin market metrics?

One of the most illuminating metrics when it comes to gauging where the market is headed is MRVR (market value to realized value). This indicator shows the amount of potential profit the traders have yet to have realized. Another useful market metric is the so-called Puel Mulitple, which shows the ratio between the year-long moving average and the total dollar value of Bitcoin that is mined over one day period. Both metrics point towards a possible market reversal, as BTC seems to be trading undervalued at the moment.

Image source: CoinMetrics

At the end of the day, even if Bitcoin price were to drop to the $20,000 – $25,000 range, it will very likely reach $100,000 by the end of the year. The chart below compares the previous three Bitcoin halving epochs and corresponding price movements, which pushed the price up 20x. Each time, a similar pattern occurred at each halving’s start, before the price eventually surged to new highs. We are seemingly again tied in the same historical trend, which bodes well for the future and means we could be in for a wild ride throughout the end of 2021 and beyond.

Image Souce: CoinMetrics

Chinese crackdowns continue to have a severe impact on the industry

Chinese authorities have put a considerable dent on Bitcoin mining across its territory in the most recent quarter. As Chinese miners account for by far the largest share of global BTC mining distribution, Beijing’s actions have been strongly felt. As a result, the overall computational mining capabilities, measured as a Bitcoin hashrate, have taken a tumble and have dropped from 200 million TH/s to 90 million TH/s in Q2.

Image Source: CoinMetrics

Following Chinese crackdowns, which forced mining operations out Qinghai, Inner Mongolian Yunnan and Sichuan regions, an interesting turn of events took place. As Chinese mining pools were forced to shut down or vastly scale down their businesses, miners are searching for new locations to re-establish their headquarters. The US has previously made considerable VC investments in the sector and is likely going to capture some of the fleeing miners. Kazakhstan has also emerged as a likely candidate for new miner operations.

While the cryptocurrency space is currently suffering from the upheaval caused by China, long-term speaking the situation will likely end up in crypto’s favor as mining will become much more decentralized.

“I think this is a signal that in the future, bitcoin mining will be more distributed by necessity. Less mega-mines like the 100+ megawatt ones we see in Texas and more small mines on small commercial and eventually residential spaces. It’s much harder for a politician to shut down a mine in someone’s garage.”

Steve Barbour, founder of Upstream

Upcoming Taproot upgrade proves Bitcoin is not an “old technology”

In June, Bitcoin miners have expressed overwhelming support for Taproot Bitcoin upgrade. The upgrade will improve privacy through a process of making complex and simple transactions indistinguishable from one another. The upgrade will roll out sometime in November this year, at block number 709,632.

Taproot upgrade will signify the biggest upgrade to the protocol since 2017’s block capacity enhancement. Hopefully, it will do away with the prevailing narrative that Bitcoin is too slow to change and adapt to quickly changing market conditions. Despite requiring decentralized consensus to deploy changes, first proposed in its white paper, Bitcoin shows a remarkable ability to do so in a timely manner.