After posting a new ATH market capitalization exceeding the one from 2017 already on November 24, the Bitcoin price has finally surged past the $20,000 mark to reach the cryptocurrency’s long-awaited new all-time high price, which now sits at $22,268. The market conditions are still looking bullish. Even the famous whistle-blower Edvard Snowden praised the important milestone of the world’s greatest decentralized currency on Twitter:

Bitcoin’s Previous Price ATHs

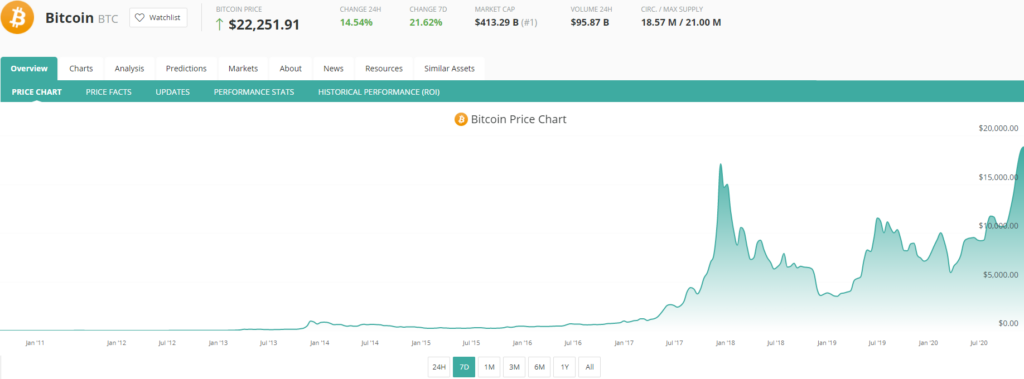

Bitcoin surging past $20,000 is a great milestone to look back into the history and reminisce on how Satoshi Nakamoto’s creation came so far. The first higher peak of Bitcoin’s price could be seen more than 4 years after the blockchain’s genesis in April of 2013, when the BTC reached a price of $230. While this first major ATH was followed by a big correction, which found a bottom at below $70, the price gradually recovered towards the end of 2013 and then rallied in November. On November 28, the BTC price surged past $1000 for the first time in the history and the 2013 bull run peaked at $1,135 on December 1. After that, it took Bitcoin more than three years to reach this price and post a new ATH in March 2017. But this was only the very beginning of the great bull market of 2017, which reached its peak on December 17, 2017 at a price just below $20,000 (exact value of the ATH varies depending on exchange platform). The 2017’s price peak claimed the title of the Bitcoin price ATH until November 30, 2020, when Bitcoin briefly surpassed the 2017’s highest valuation on several exchanges. However, on December 16, 2020, just one day shy of 3 years after the peak of 2017’s bull run, Bitcoin confidently broke above $20,000 and exceeded its previous ATH by more than $1,000.

While the World was falling apart due to COVID-19, Bitcoin Thrived in 2020 So Far

The year 2020 will likely go down in the history as the year of the COVID-19 pandemic, caused by a tiny novel coronavirus named SARS-CoV-2 managed to flip our lives upside down and devastate global economies in mere 1 year of its existence. While the effect of the pandemic is horrendous on most industries and the economy in general, the inflation safe-haven assets, such as precious metals and cryptocurrencies have thrived this year. Especially Bitcoin, which has a capped maximum supply (21 million BTC) and a predetermined issuance schedule emerged as an attractive for the allocation of one’s liquid assets, as continues money printing by governments sowed fear of inflation. In addition, this year has brought several very positive developments that have done a great deal to legitimize Bitcoin and to a lesser extent, the crypto asset class as a whole. However, there is one more important factor that makes the 2020’s bull run so much different from the ones seen before – the involvement of institutional money.

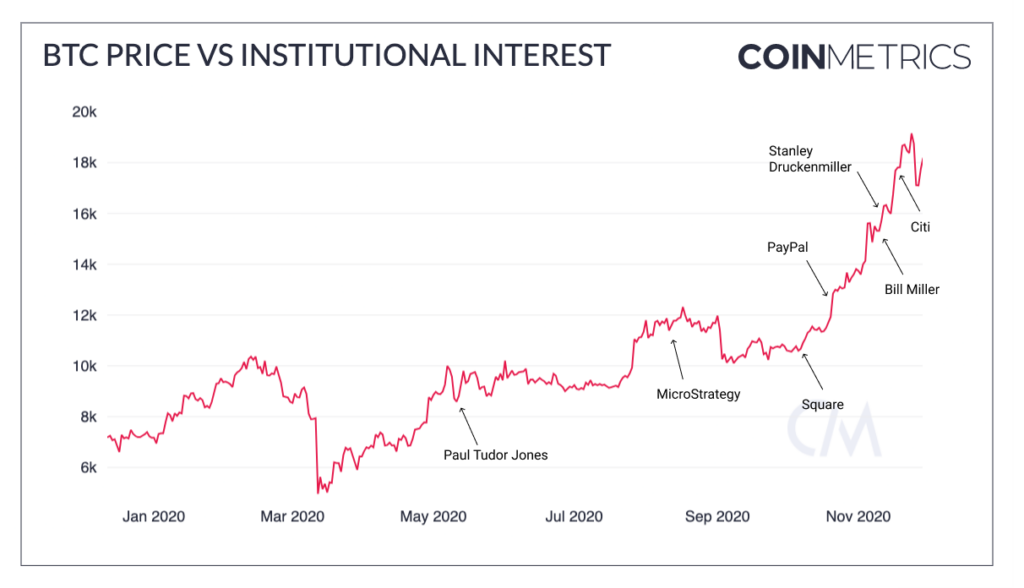

Institutional Investors are Major Drivers of This Rally

Institutions have been slowly opening to cryptocurrency and Bitcoin for quite some time now, but the volumes of institutional investments made in 2020 are far higher than ever seen before. Perhaps the statement made by a well-known macro investor Paul Tudor Jones in May, when he disclosed that he has allocated almost 2% of his portfolio to Bitcoin, citing the risk of inflation as a primary reason for this decision, has further opened the eyes of asset managers from the corporate world. Two of the largest stories of this year were definitely the MicroStrategy’s massive investment in Bitcoin worth over $450 million in total and a smaller $50 million BTC allocation made by a financial services company Square. As their investments are paying off plenty smaller corporate investments started to pour in. Charles Hayter, Co-Founder and CEO of CryptoCompare summarized the 2020 market conditions in a statement:

“The corporate investments in Bitcoin from the likes of Square, Microstrategy and more recently Ruffer and MassMutual have caught the attention of the investing world. This growing demand is simply outstripping Bitcoin’s low and fixed supply. I expect more corporations to follow suit in 2021. With the macroeconomic backdrop of unprecedented monetary expansion and negative real interest rates spurred on by COVID-19, it is no wonder that investors of all types are looking at hard assets like Bitcoin as an alternative to gold. Unlike the retail-driven bull run in 2017, institutional investors can allocate capital effectively and with considerably lower risk as the markets are more mature, efficient and regulated.”

The influx of big money is best illustrated by the growth of Grayscale Bitcoin Trust (GBTC), which posted record inflows in 2020. Being the only way to trade BTC via the traditional financial market in U.S., Grayscale attracts mainly institutional investors. Data from Q3 2020, shows that 84% of the $1.05 billion invested in Grayscale’s crypto products came from institutional investors.

Last but not least, the online payments giant PayPal has finally taken a dive into the cryptocurrency world by announcing a cryptocurrency buying and selling feature on October 21, 2020. The feature, which is already live for PayPal’s U.S. customers has a potential to expose the platform’s massive (290 million strong) userbase to crypto assets, when the service is gradually expanded to other jurisdictions. The payment processor aims to do this in early 2021. Nevertheless, the news about this integration alone triggered a smaller bull run at the end of October.

How high can Bitcoin Go?

While nobody knows the answer to this question, many Bitcoin bulls believe that Bitcoin is still very undervalued. Famous Bitcoin educator and Morgan Creek Digital partner Anthony Pompliano, for example, believes that Bitcoin will change hands at a price around $100,000 by the end of 2021. As we said at the beginning, the market is still bullish, and Bitcoin could have another yet higher price up the sleeve.