Key takeaways:

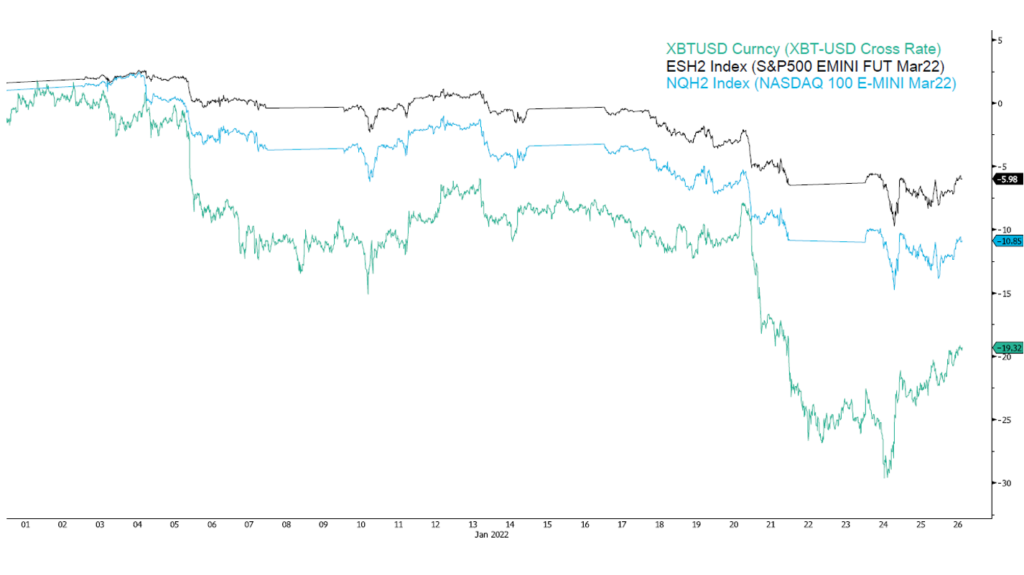

- Bitcoin has lost more than a fifth of its value during January 2021, as traditional expansionary assets also faced notable downward movement

- At its lowest point during the first month of 2022, the price of Bitcoin was 52% removed from last November’s all-time high

- Bitcoin’s poor performance can be attributed to a series of macroeconomic factors, highlighted by a tightening of the money supply announced by the Fed

The start of 2022 was a turbulent ride for the blockchain industry – the value of Bitcoin and other digital assets has shrunk by high double digits. The combined valuation of all digital currencies in circulation fell to $1.75 trillion at the end of January, just two months after the historic milestone of $3 trillion was breached last November.

Macroeconomic drivers, not poor fundamentals, have led to Bitcoin’s subpar performance

The beginning of this year was characterized by a series of macro drivers that have had a major impact on the price of expansionary assets, including cryptocurrencies. The spread of the coronavirus “Omicron” variant, rising tensions on the Russia-Ukraine border, and a tightening of monetary supply by the Federal Reserve have contributed to a notably risk-averse environment.

The initial announcement of the interest rate hike at the beginning of the month led to Bitcoin and a large number of other digital assets shedding over 10% of their value in the span of 24 hours, after trading in a relatively tight range for a couple of weeks prior to the sudden drop.

January’s second notable market pullback, which pushed the total market cap below $2 trillion, started on Friday, January 20, and lasted for a couple of days. The call of Russia’s central bank for a blanket ban on crypto coincided with the market drop, but it is difficult to say how much of a role it played. Russian tech and political leaders quickly dismissed the proposed ban, fearing such legislation could have a devastating effect on the Russian IT sector.

At the time, Bitcoin fell to the $32,000 level, which many analysts identified as the local bottom. Shortly after, key market indicators turned green, and Bitcoin swiftly recovered a large chunk of its lost value and began a steady rebound, which saw its price reach $37,700 at the time of this writing.

One important on-chain metric that points to a potential market trend reversal is Bitcoin miners’ unwillingness to sell their digital holdings. According to blockchain analytics firm CryptoQuant, miner reserves have reached their peak 12-month value at the tail end of January 2022. BTC miners sit on a stash of 1.86 million BTC, worth more than $70 billion at current market rates.

Final thoughts

Generally speaking, the world’s largest crypto seems to be in a state of limbo – its market performance appears to be almost entirely dependent on macroeconomic factors outside the domain of blockchain technology. It is worth noting that periods of significant market drawdowns had historically presented some of the best buying opportunities. For instance, Bitcoin had lost more than 80% between Dec. 2013 and Jan. 2015, and Dec. 2017 and Dec. 2018, and both times pushed to a new all-time high once the markets eventually recovered.