Frequently swapping between different cryptocurrencies can be a costly endeavor, especially when using services that charge high trading fees. With Binance Swap Farming, users can exchange dozens of different tokens at a low swap fee rate. On top of that, Swap Farming users get to earn up 50% in BNB rebates.

Swap Farming is a part of the Binance Liquid Swap platform, which is an automated market maker (AMM) similar to decentralized treading protocols like Uniswap or PancakeSwap. However, contrary to the two popular decentralized exchanges (DEXs), Binance Liquid Swap is not a decentralized platform, but instead uses the same principles albeit in a centralized manner. The end result is a fast and cheap service that supports a wide range of digital assets.

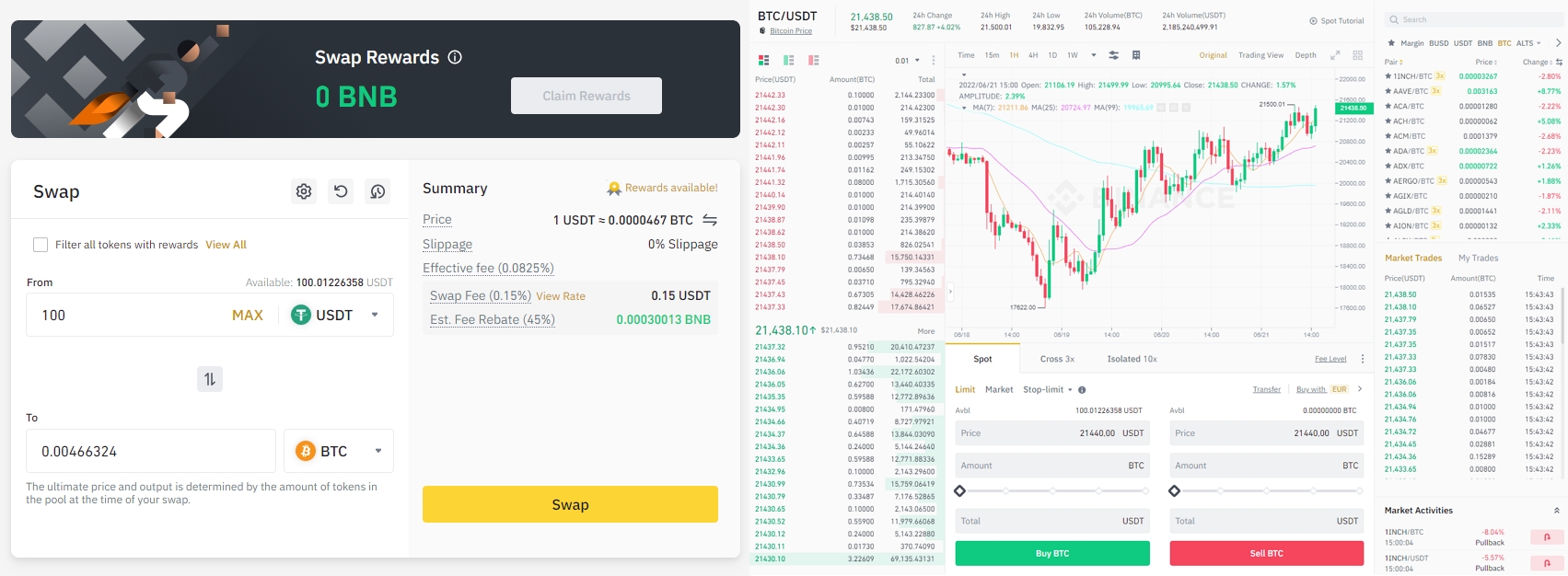

Arguably the main selling point of Binance Swap Farming is its intuitive interface that allows traders to buy and sell digital assets via a streamlined and user-friendly UI that is much simpler and easier to use than Binance’s dedicated trading section, with its myriad of order types and advanced trading functions. We’ll cover this distinction in more detail in the following sections. First, let’s take a look at how Binance Swap Farming works.

How does Swap Farming work?

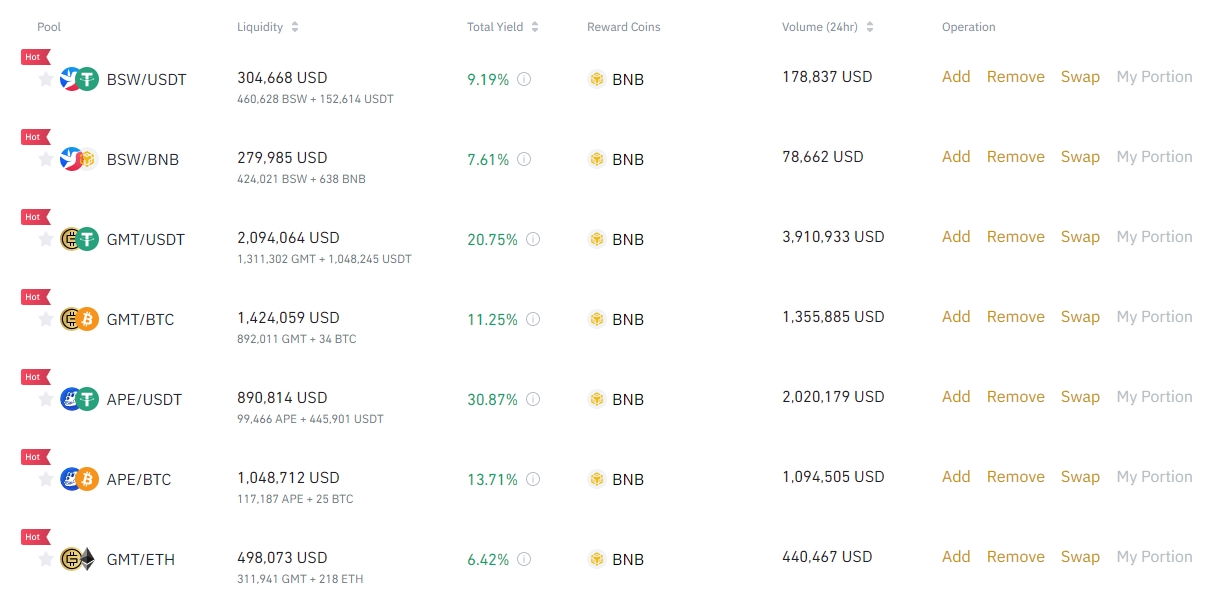

Swap Farming makes use of token liquidity pools consisting of two digital assets, for example, Bitcoin (BTC) and Ethereum (ETH), or Binance USD (BUSD) and Tether (USDT). Liquidity providers contribute their holdings to the pools in exchange for liquidity farming rewards, consisting of flexible interests and transaction fees, that are issued in BNB.

Users can choose to contribute either token to the pool or choose to provide both. Tokens contributed to the liquidity pools can be removed at any time. The pools allow tokens to be traded and exchanged, which incurs a fee. A part of the fee generated by Binance is distributed to liquidity providers in exchange for their liquidity-providing service.

The Swap Farming product taps into the liquidity provided by the Binance Liquid Swap platform for low-fee trades and Swap Farming rewards.

How to buy and sell crypto with Swap Farming?

The process of buying and selling crypto with Swap Farming couldn’t be more straightforward. Here’s a quick step-by-step guide showing how to use Swap Farming on a desktop client.

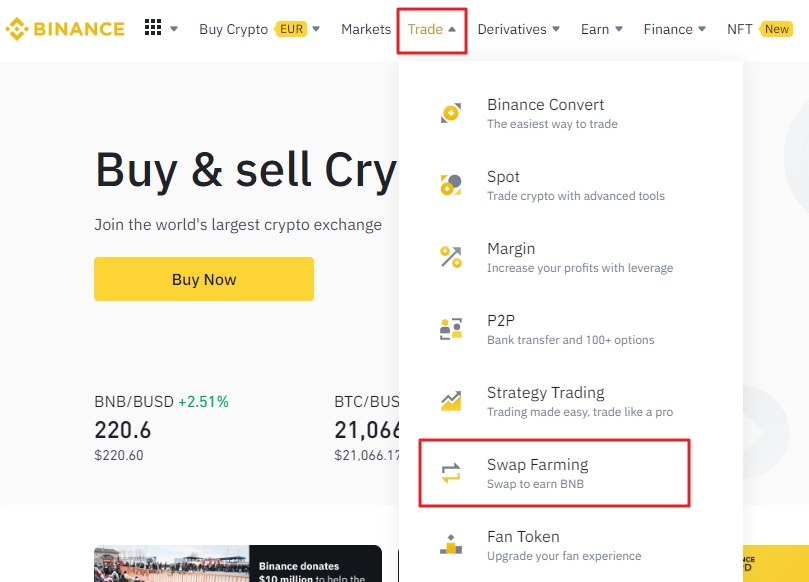

Step 1 – Login into your Binance account. On the Binance homepage, select “Swap Farming” for the “Trade” drop-down menu.

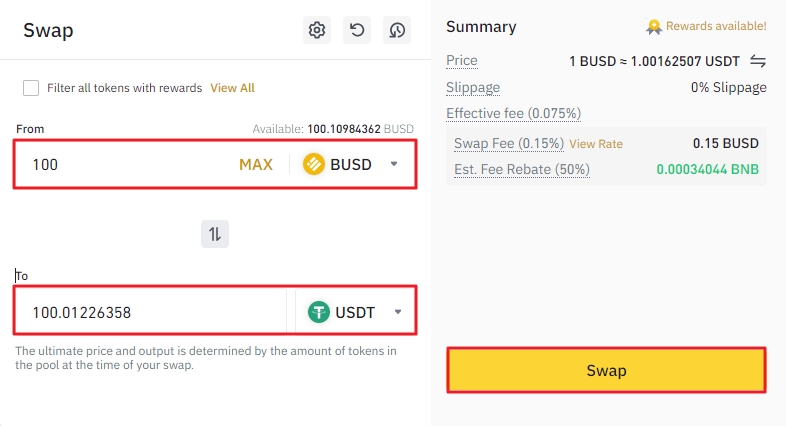

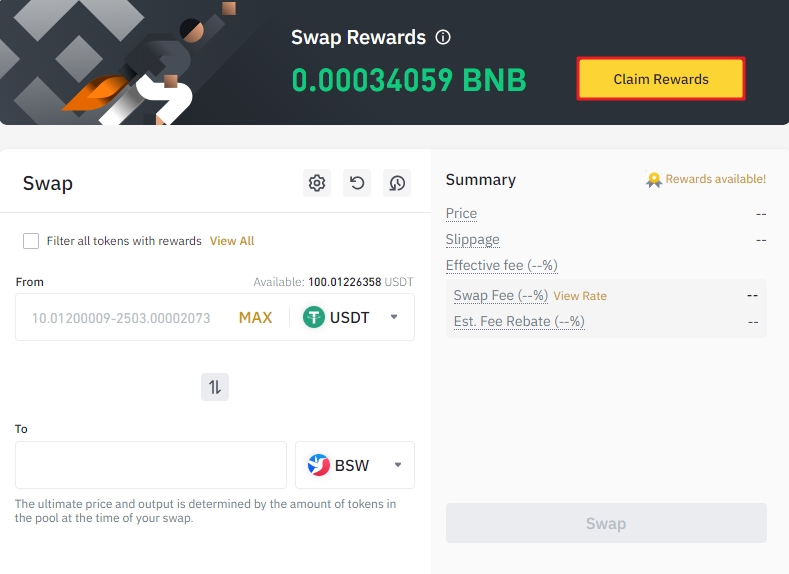

Step 2 – Pick the digital asset you would like to exchange and enter the amount. On the right side of the screen, there is information about the swap fee, potential slippage rate, and estimated fee rebate. Click “Swap” once you are ready to proceed.

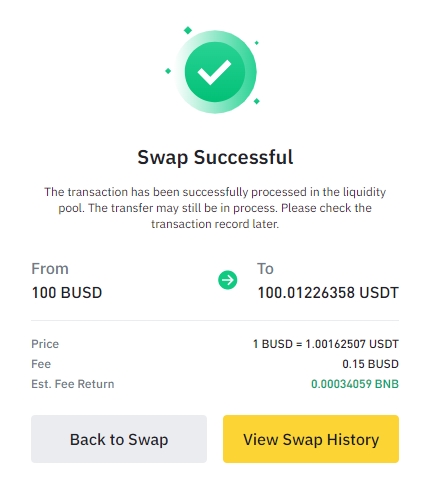

Step 3 – Once the swap is complete, you will be notified with a popup that includes details about the swap order.

How to claim Swap Farming rewards?

The BNB Swap Rewards are credited moments after a cryptocurrency swap is executed. To claim the rewards, return to the Swap Farming page and click on the “Claim Rewards” button located above the Swap dashboard (see image below).

As you can see, we have received roughly 0.00034 BNB when swapping 100 BUSD for 100 USDT, which translates to a 50% fee rebate. This means that our effective token exchange rate was lowered to 0.075% down from the default value of 0.150%.

Using spot markets to make the same trade would have cost us 0.100%, which means that using Swap Farming proved to be considerably cheaper, not to mention easier and faster.

Crypto Swaps and Rewards history

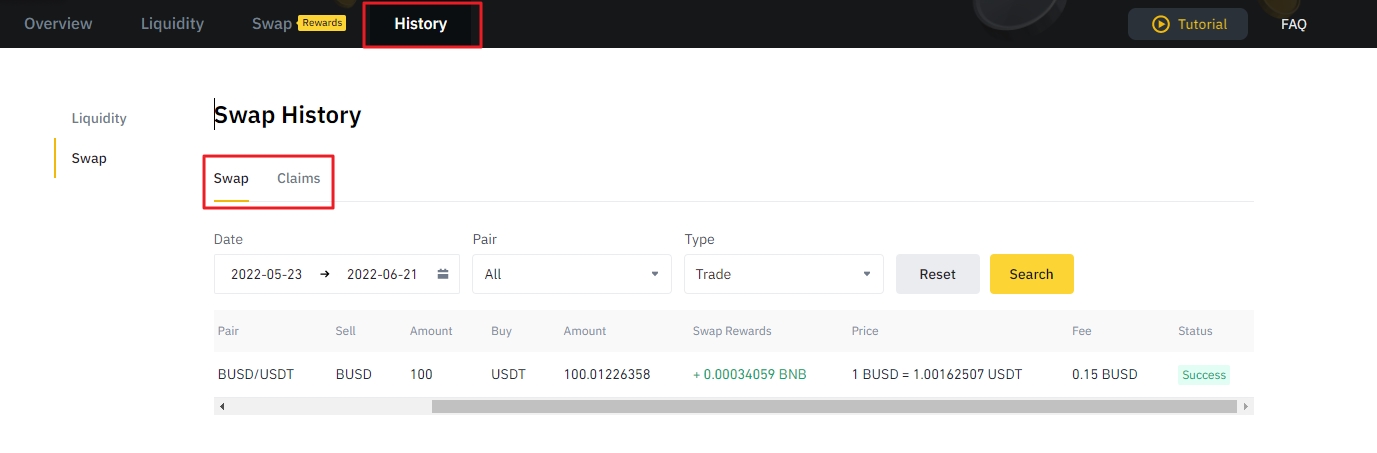

The cryptocurrency swap and reward claims history can be accessed via a dedicated dashboard. Select the “History” tab next to the Swap Farming tab to see a list of past swap and reward claims.

The history dashboard included a detailed overview of past transactions, including trading pair information, amount, asset price at the time of the swap, trading fee, and swap reward amount. Similarly, the rewards history shows the amount of past rewards and the date and time at which they were claimed.

Pros of using Swap Farming

There are several pros when it comes to the Swap Farming feature on Binance. Here are some of the product’s key advantages:

User friendly

Swap Farming is easy to use and can be a good entry point for newcomers to trade cryptocurrencies. While the product obviously doesn’t boast as many features as a spot market trading service, it provides the core functionality and arguably the only one that matters to many newcomers – buying and selling crypto with only a couple of clicks.

Arbitrage opportunities

Experienced users might find Swap Farming as a good outlet to pursue arbitrage opportunities that arise due to minute differences between token trading pair prices in spot markets and liquidity pools.

Capital efficient

Due to the size and popularity of the Binance Liquid Swap platform, traders can easily tap into token pools that provide a higher degree of liquidity than most decentralized exchanges. In practice, this leads to a lower slippage rate (especially when trading larger sums of crypto), which in turn lays the groundwork for greater capital efficiency.

Swap rewards and VIP requirements

Binance is giving up to 50% of the transaction fees generated by cryptocurrency swaps back to users in the form of BNB tokens. On top of that, crypto swap transactions count towards the overall trading volume on Binance, which allows traders to climb the VIP ranks for even greater trading fee discounts and exclusive perks.

Secure

Since Swap Farming is a part of the centralized Biance Liquid Swap platform, users are less likely to become victims of a hack or an exploit, which are unfortunately pretty commonplace when using DEXs. In addition, users’ funds are protected by the Secure Asset Fund for Users (SAFU) emergency fund which was valued at $1 billion in January 2022.

Cons of Swap Farming

Although there are several advantages to using Swap Farming, it is worth noting that there are certain risks users should be aware of before using the service.

The most important thing to consider is the slippage rate, which is most commonly a problem for users who are trading larger sums of crypto and using tokens that are featured in pools that have low liquidity. Slippage refers to the discrepancy between the expected price of a trade and the price at which the trade is executed. When placing a large swap order, a part of the trade is can be executed at a certain price and the remainder at a different price. It is worth noting that Binance provides the expected slippage rate information before the user performs a crypto swap.

Next to slippage, the risk of impermanent loss (IL) is another thing to consider. While IL is not a factor when it comes to Swap Farming directly, it can be an important consideration for users that provide liquidity in Binance Liquid Swap’s liquidity pools. Impermanent loss refers to a net difference between the value of two cryptocurrency assets in a liquidity pool-based AMM. For more information about IL, check out this helpful article from Binance.

Exclusive Swap Farming promotions

High-volume and first-time Swap Farming users can earn additional rewards thanks to exclusive promotions that generally run once per month. Each competition usually shines a spotlight on certain liquidity pools and tokens.

For instance, the Swap Farming trading promotion that took place earlier this year saw 40,000 WOO Network (WOO) tokens distributed among eligible users. The lion’s share of the entire token distribution (30,000 WOO) was reserved for WOO/BNB and WOO/USDT liquidity pool users.

Closing thoughts

With Binance Swap Farming, users can buy and sell cryptocurrencies with ease and efficiency, while having the chance to earn BNB rewards that can slash the effective trading fee rate in half. To make the deal even sweeter, Binance regularly runs exclusive Swap Farming events that can provide an additional incentive to use the swap service.