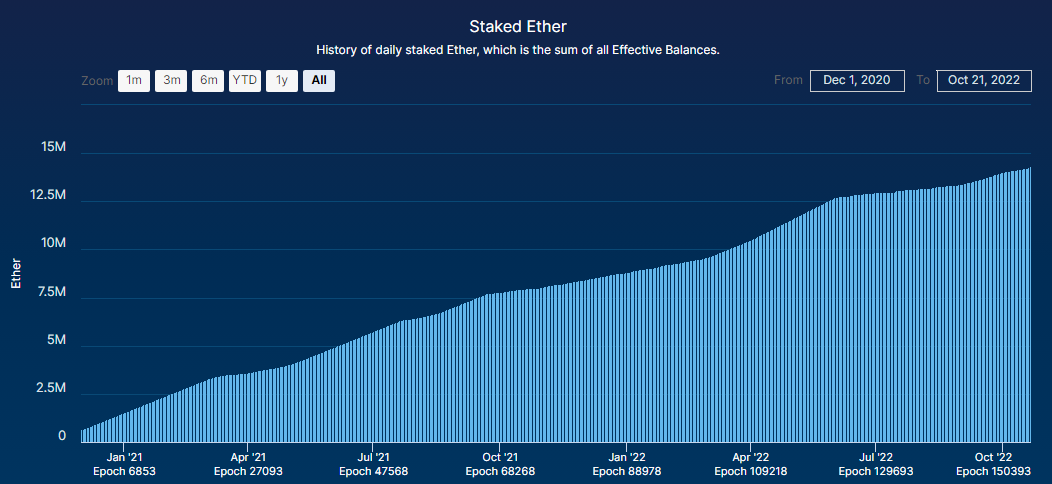

Staking Ethereum coins is one of the most popular passive-income methods in the crypto industry. As of the middle of December 2022, nearly $20 billion worth of ETH is staked in the Beacon Deposit Contract.

Sparring technical details, ETH that is stored in the smart contract is used to secure the Ethereum network and verify transactions. Users that stake their ETH receive staking rewards in exchange for their participation.

However, there are several caveats when it comes to staking Ethereum as an individual. For starters, there is a 32 ETH requirement and a decent level of computer knowledge needed.

Binance ETH 2.0 looks to solve that problem by streamlining the Ethereum staking process and lowering the minimum staking requirement to just 0.0001 ETH, making it available to a much broader range of people.

What makes Ethereum staking possible? Read along.

Ethereum Merge: How the biggest smart contract platform became 99.95% more efficient

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud, or third-party interference. These apps run on a custom-built blockchain, an enormously powerful shared global infrastructure that can move value around and represent the ownership of property.

For the first couple of years after its launch, Ethereum had relied on the Proof-of-Work (PoW) consensus algorithm to secure the network and generate new blocks of the Ethereum blockchain. PoW requires powerful hardware and lots of energy by design.

Everything changed on September 15, 2022, when the Ethereum network successfully transitioned from PoW to the Proof-of-Stake (PoS) consensus algorithm. Instead of relying on solving complex mathematical problems to verify transactions, PoS allows owners (in this case, ETH) to sake their coins, which gives them the right to validate new blocks of transactions and add them to the blockchain.

This allowed the Ethereum network to consume in excess of 99% less energy than before. Ethereum founder Vitalik Buterin estimated that the world’s energy consumption was reduced by an astonishing 0.2% as a result of the transition.

Many argue that this move – widely known as “The Merge” – was the biggest update in the history of crypto.

What comes after the Merge?

The Merge set up the stage for a series of Ethereum updates that will culminate in a network that is capable of processing up to 100,000 transactions per second (TPS) down the line.

Following the Merge, the Ethereum upgrade will undergo four major development cycles, including the Surge, which will introduce sharding; the Verge, which will drastically reduce computational requirements; the Purge, which will decrease the hard drive space requirements; and the Splurge, which will enhance security and bring other quality of life improvements.

The full roadmap will undoubtedly take years to complete. For context, in January 2022, Ethereum founder Vitalik Buterin said that the development was roughly at the halfway point. Following the Merge (now completed) and the Surge, the roadmap will be 80% complete, noted Buterin during a two-hour Bankless podcast episode

What is Ethereum (ETH) staking?

Ethereum staking is the process of allocating a certain amount of Ethereum (ETH) and using it to help secure the Ethereum blockchain network. When users hold and stake their ETH, they are participating in the Ethereum proof-of-stake consensus mechanism, which allows the network to reach a consensus about the state of the ledger without the need for mining.

Holders of ETH who participate in staking are rewarded with a share of the transaction fees, also known as staking rewards. This means that by staking their ETH, users can earn a passive income. The amount of staking rewards each user is eligible to receive depends on several factors, including the amount of ETH they are staking, the overall amount of ETH being staked on the network, and the current inflation rate of the network.

Overall, Ethereum staking allows users to earn a passive income while simultaneously helping to secure the Ethereum network. It is an important part of the Ethereum network and helps to ensure the overall health and stability of the Ethereum blockchain.

How to stake ETH?

For the vast majority of users, the requirement of having 32 ETH to become an Ethereum validator can be prohibitively expensive. In addition, setting up and running one’s own node can be a difficult and time-consuming process that requires specialized knowledge and hardware.

Staked ETH is locked until Shanghai, the next major Ethereum update, goes live on the mainnnet.

As an alternative, users can participate in staking pools to earn ETH staking rewards. While staking pools typically offer lower returns than solo staking, they are easier to set up and require a smaller amount of ETH. Popular staking pool services include Lido DAO and Binance Staking, which charge a fee for their services and distribute ETH rewards in the form of STETH and BETH tokens.

In the following sections, we’ll focus on Binance ETH 2.0 Staking, one of the leading Ethereum staking platforms in the industry.

How to stake Ethereum and earn ETH 2.0 rewards on Binance?

The entire process of staking Ethereum on Binance takes just a couple of clicks, making it one of the most accessible solutions in the space. First, you’ll have to make sure that you have ETH funds in your Binance account. If you don’t yet have ETH in the wallet, you can easily buy it through Binance’s spot market offering, or convert existing crypto funds to ETH. You can use the Swap Farming solution to earn BNB rewards when converting crypto.

With ETH available in your account, we can move on to describing how to stake ETH. Open Binance ETH 2.0 Staking platform to get started.

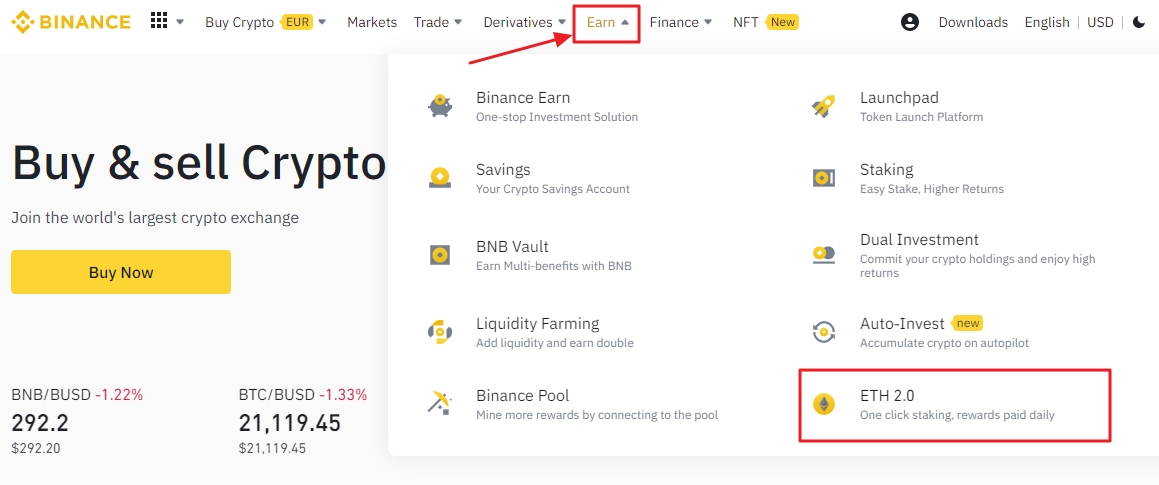

Step 1: Log in to your Binance account and open ETH 2.0 Staking

As mentioned before, you’ll first need to log in to your Binance account. Then, select “ETH 2.0” from the “Earn” drop-down menu.

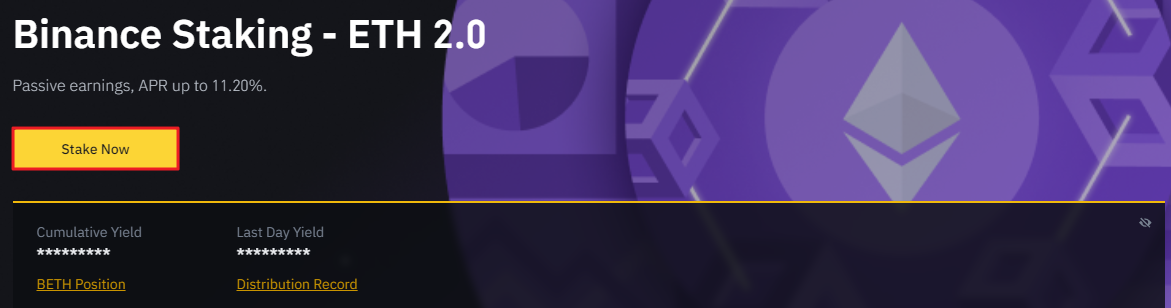

Step 2: Click “Stake Now”

From the Binance ETH 2.0 Staking homepage, click on the “Stake Now” button that is located in the top left. A pop-up window will appear.

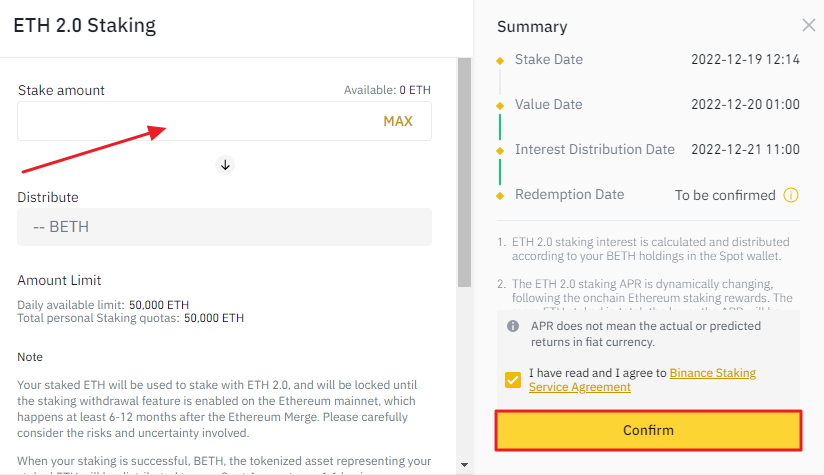

Step 3: Enter the amount of ETH you wish to stake

Enter the amount of Ethereum you would like to stake. On the right side of the screen, you’ll find the interest distribution date (which is yet unknown), and other relevant information. Click “Confirm” to proceed.

Keep in mind that the ETH funds allocated for staking will remain locked until the Shanghai update goes live on the Ethereum mainnet.

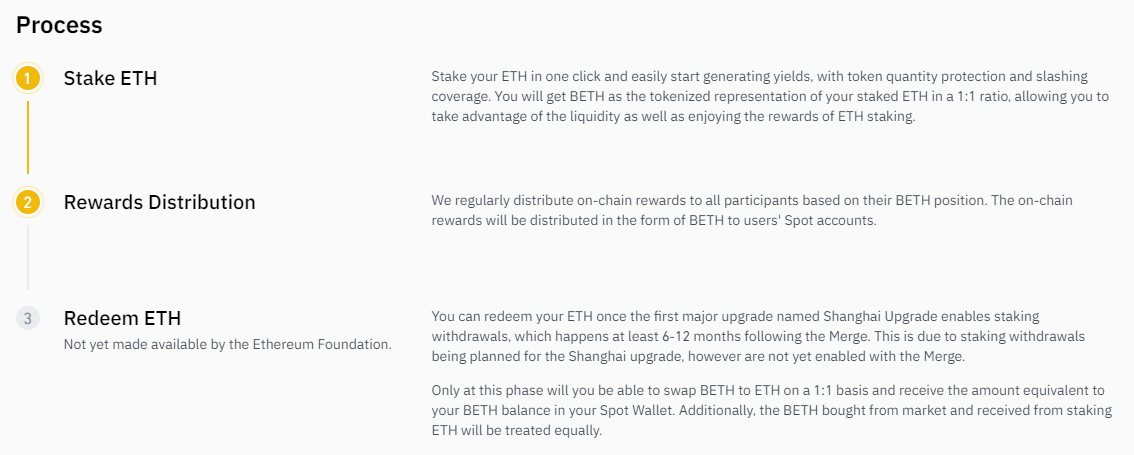

Step 4: Receive a corresponding amount of BETH and start earning Ethereum staking rewards

Congratulations, you’ve successfully staked your ETH and will begin earning staking rewards shortly. Keep in mind that a corresponding amount of BETH will be deposited to your spot account, at a 1:1 ratio of your staked ETH.

The on-chain rewards will be distributed in the form of BETH. BETH can be freely exchanged for other cryptocurrencies in the markets, which means that Binance Staking users benefit from increased liquidity. The entire process of staking ETH, including the mechanics of BETH and the redemption process, is outlined on the Binance ETH 2.0 Staking homepage.

With that in mind, let’s explore the benefits afforded by BETH and other advantages of the Binance Staking platform in more detail.

What are the benefits of Binance ETH 2.0 Staking?

Compared to other platforms and approaches that allow users to earn staking rewards, Binance offers several perks that set its service apart from competitors. These benefits include:

Retain liquidity through BETH

BETH is a tokenized representation of ETH that users receive upon staking their Ethereum on Binance. This affords them the opportunity to use the full value of locked ETH and use BETH as they please. After the Shanghai update, BETH will become fully redeemable for ETH, at a 1:1 ratio.

Also, BETH can be obtained via spot markets, which means that users can benefit from earning Ethereum staking rewards without actually having to buy and stake ETH.

Easy to use

Staking Ethereum on Binance takes only a couple of steps to complete and is incredibly easy to use. In addition, the service provides simple explanations of each step, making it easy for newcomers to understand and participate in the process of staking Ethereum. Also, those who use Binance Staking do not have to worry about taking care of their own security keys, as is the case when staking as an individual user.

Low ETH requirement

The low ETH entry requirement is one of the most important benefits of Binance’s staking offering. Since the minimum deposit is just 0.0001 ETH, virtually anyone can afford to use the service.

Up to 11.2% APR

With an Annual Percentage Rate (APR) of over 11%, Binance Staking offers one of the highest yearly rewards rates in the Ethereum staking space. Here’s a quick comparison between Binance, and other popular Ethereum staking services in the market.

| Binance | Coinbase | LidoDAO | |

| Tokenized Asset | BETH | cbETH | STETH |

| APR | up to 11.2% | up to 6.85% | up to 4.8% |

In addition to offering exceptionally high rewards, Binance covers all slashing risks, which means that users receive the full share of staking rewards even if there are some problems with transactions validation.

Final Thoughts – Binance ETH 2.0 Staking

It is widely expected that ETH that is staked will get unlocked with the release of the Shanghai update sometime next year. Ethereum devs have recently reached an agreement on the mainnnet rollout for Shanghai and are targeting March 2023 for release, according to the latest reports. It is worth noting that the Merge saw several multi-month delays, so the March release for Shanghai should likely be taken with a grain of salt.

This is the main reason why solutions like Binance ETH 2.0 Staking, which allow users to leverage the passive income benefits of Ethereum staking, while retaining liquidity via tokenized assets (in Binance’s case, BETH), are becoming increasingly popular recently.

Other important reasons why users are flocking to services such as Binance Staking are the ease of use and the incredibly low barrier to entry.

Hopefully, this article helped you understand what Ethereum staking is and how you can start earning ETH 2.0 rewards on Binance.