Binance Margin is a cryptocurrency investment platform that enables traders to magnify their exposure to digital asset markets by borrowing capital from a third party. Binance’s margin trading platform offers several benefits over its crypto competitors, namely the large selection of supported tokens, low fees, and high liquidity.

In this article, I am going to explain why I have chosen Binance Margin as my preferred platform, how I use margin to pursue profitable investments, and what are the differences between Binance Margin and competing platforms.

Why do I use Binance Margin?

To be frank, there is no single reason why I have chosen to use Binance Margin. I remember first trying out the platform soon after its launch in 2019, and I was immediately impressed with the interface, large selection of trading pairs, and leverage options. It seems that many crypto investors shared this sentiment as Binance’s margin solution had quickly risen through the ranks and became the leading platform in the sector.

The ability to borrow extra funds in exchange for an interest rate payment in order to enter larger trades than my portfolio allowed quickly piqued my interest. This was especially the case as the crypto market was in a prolonged slump following the 2018 market crash, which led to Bitcoin and other assets trading mostly sideways for the better part of 3 years, between 2018 and 2021.

Somewhat bored by the slow spot trading action at the time, I turned my attention to margin trading. It allowed me to pursue leverage trades that turned small market movements into decent profit-making opportunities. It’s true that crypto futures instruments could have fulfilled a similar role, but I was always somewhat taken aback by the idea of trading derivatives instead of physical assets. It’s just a preference I have, I guess.

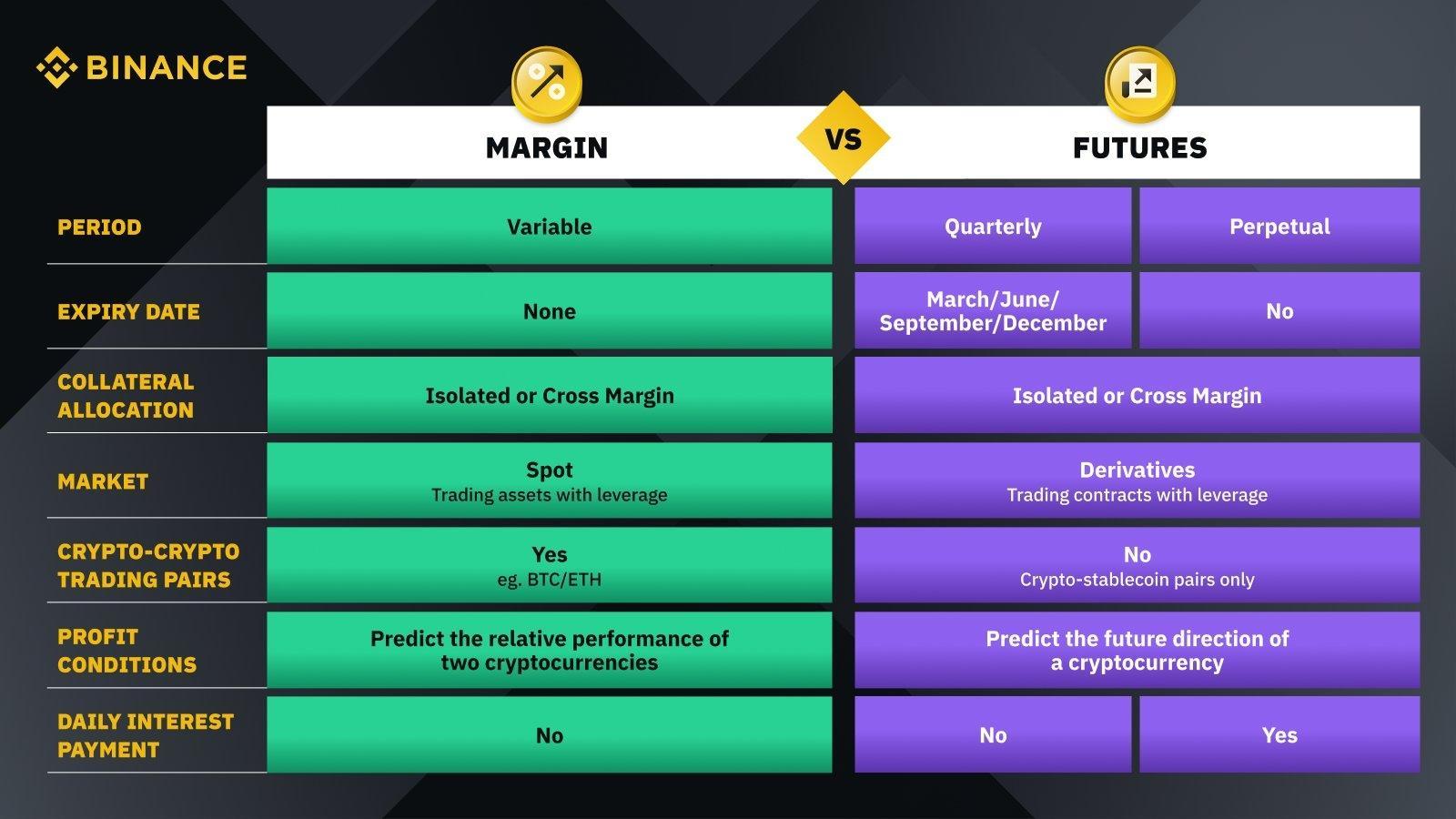

If you find the differences between Margin and Futures platforms somewhat confusing, Binance’s table below can help you gain a better understanding.

If you have additional questions regarding the two trading platforms, I recommend reading Binance’s excellent article on the topic.

Let’s proceed by discussing the benefits of margin trading on Binance.

5 benefits of using Binance Margin

Let’s give over 5 main reasons why you should give the Binance Margin platform a try. Keep in mind that this selection is derived from my personal use of Binance Margin over the years, and should not be taken as a definitive list of Binance Margin’s best features.

Ability to magnify trading profits

In my opinion, the whole purpose of Binance Margin, and its main benefit, is to allow traders to pursue higher potential returns than what is possible when trading with no leverage.

Here’s how that works in practice: Imagine buying 1 ETH for $1,000. It then rallies to $2,000. If we sell it, we make a profit of $1,000. Meanwhile, using margin funds to secure a 2:1 leverage (effectively borrowing 1 ETH, while staking our existing 1 ETH as collateral), the same market move would generate a profit of $2,000 (after repaying the 1 ETH that we’ve borrowed).

The simplified example above showcases the power of margin trading. However, there is a caveat you must be aware of. When trading on margin, negative market activity can result in liquidation. If we were to long ETH and it dropped from $1,000 to $500 while using 2:1 leverage, we would be in very real danger of liquidation, losing the entirety of our starting 1 ETH position in the process. In this case, we would have to respond to the margin call by depositing additional collateral to cover potential losses.

The bottom line here is that margin trading magnifies moves in the crypto market, both positive and negative. For this reason, risk management tools, like take-profit and stop-loss orders, are crucial.

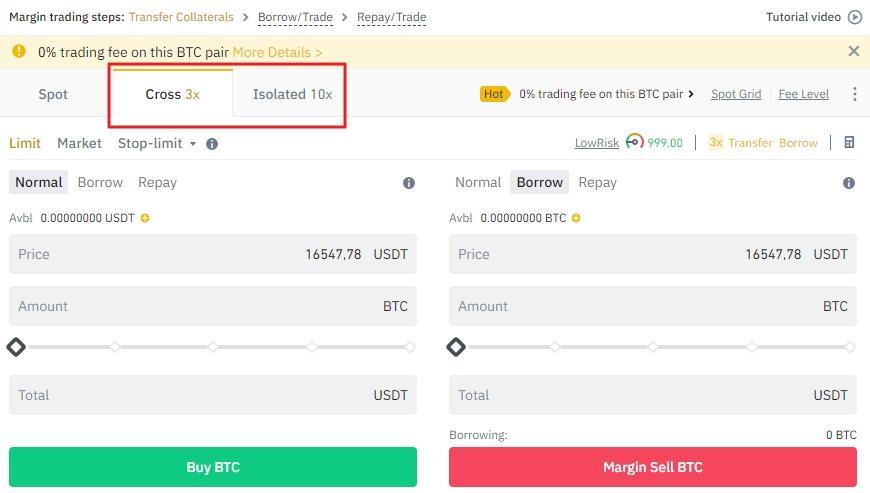

Isolated and cross-margin options

Isolated Margin places a restriction on the maximum amount of funds that can be used to margin trade, by limiting it to funds that are reserved for a particular trading position. When a trade goes bad, only the trading position that has been negatively affected can be liquidated.

On the other hand, Cross-margin is designed to offset losses from a particular position across a range of other positions in a trader’s margin account. This makes meeting margin requirements less of a hassle, however, a bad trade can liquidate all margin positions.

If you are just starting out, I suggest that you stick to isolated margin. Once you get more comfortable with swings and responding to margin calls, you can switch to cross-margin to attain higher potential returns.

Make “long” and “short” trades

With Binance Margin, users can make a profit regardless of the direction of price movement. You’ve probably heard of it before – going long, or longing, refers to buying a digital asset with the intention of selling it back at a higher price in the future. The difference between the initial buy price and the eventual sell price is considered a long trader’s profit.

Conversely, going short, or shorting, refers to a trading practice of selling a digital asset with the intention of buying it back at a lower price sometime in the future. The difference between the initial sell price and the eventual buy price is pocketed by a short trader as profit.

As opposed to “regular” spot trades, margin trading enables investors to benefit from price changes, no matter whether these changes take place in the red or green zone.

Up to 10x leverage

Binance users can use up to 10x leverage when margin trading. In other words, they can 10x their exposure to crypto markets by using borrowed funds.

However, not all trades can be leveraged by the maximum amount. Whereas isolated margin trades feature leverage of up to 10x, cross-margin trades can’t be conducted with a leverage level of more than 3x. The reason for this is the inherent risk difference between the two margin options (see the Isolated and cross-margin options section above).

600+ trading pairs

The Binance cryptocurrency exchange’s popularity is deeply rooted in its support for countless cryptocurrencies. This fact carries over to Binance Margin as well. There are currently more than 600 trading pairs available, most of which feature high liquidity and low slippage.

Contrary to many other platforms, Binance provides trading pairs in combination with not only USDT or BTC, but also with ETH, BUSD, and DOGE. This unlocks additional avenues for Binance users looking to trade crypto with as few restrictions as possible.

Binance Margin trading tips

I follow several broad guidelines when trading on margin with Binance, and the reason for this is simple – leverage. As we all know, the crypto marketplace is a volatile place. Exposing oneself to additional volatility via leverage must be done with utmost caution and a strategic mindset. I assembled a couple of tips that have helped me become a better margin trader. Hopefully, they can help you as well.

Understanding margin-related terminology

To give yourself the highest chance of success, you really should learn about the terminology and other intricacies of margin trading. You should have comprehensive knowledge of terms like collateral, margin funds, margin maintenance, margin call, and so on. Check this helpful article from Binance Academy for more information about the subject.

Analytical mindset

The ability to analyze charts and identify market trends is paramount to forming sound entry and exit strategies. This doesn’t necessarily mean becoming a technical analysis guru, but learning about market indicators like Simple Moving Average (SMA) and Relative Strength Index (RSI) can greatly benefit you in the long run. Also, fundamental analysis can offer a birds-eye view of the sector and give insights into broader trends that shape the market.

Portfolio diversification

As the old saying goes, don’t put all your eggs in one basket. In other words, don’t let your entire crypto portfolio’s performance hinge upon the success or failure of a single digital asset. You should look to hedge your bets whenever possible. For example, you might think that the crypto gaming sector as a whole holds immense upside potential in the long term. Instead of going all in on a single project, you could instead go long on several gaming projects. It’s true that some amount of theoretical ROI is most likely sacrificed when doing so, but the risk of ruin becomes infinitely smaller as well.

How does Binance Margin compare to other platforms?

Here’s a quick look at three of the most popular crypto exchanges that support spot margin trading. Let’s see how Binance bodes against Kraken’s and KuCoin’s respective margin offerings.

| Binance | Kraken | KuCoin | |

| Opening fee | 0.02% | 0.02% | / |

| Borrow daily interest | 0.017% | 0.06% | 0.015% |

| Maintenance margin | 10% | / | 5% |

| Max leverage | 10x | 5x | 10x |

| Supported coins | 150+ | 23 | 100+ |

| Trading pairs | 600+ | 141 | 500+ |

| Coins trading against | USDT, BUSD, BTC, ETH, DOGE, fiat | USDT, USDC, BTC, fiat | USDT, USDC, BTC, ETH |

All data in the table above was collected on November 24, and fees are based on regular rates, not accounting for any VIP bonuses, promotions, or other discounts that the exchanges might offer. Also, data can vary greatly between different currencies – the info presented in the table is the lowest that we could find for each exchange (across isolated and cross-margin pairs). The “/” symbol means that we couldn’t find reliable information.

Final thoughts

Binance Margin is arguably the best platform for margin trading in the cryptocurrency industry. It features competitive rates, the largest selection of digital assets, and high-leverage options, to name just some of its benefits. Hopefully, this article helped you gain a better understanding of Binance Margin and margin trading in general.